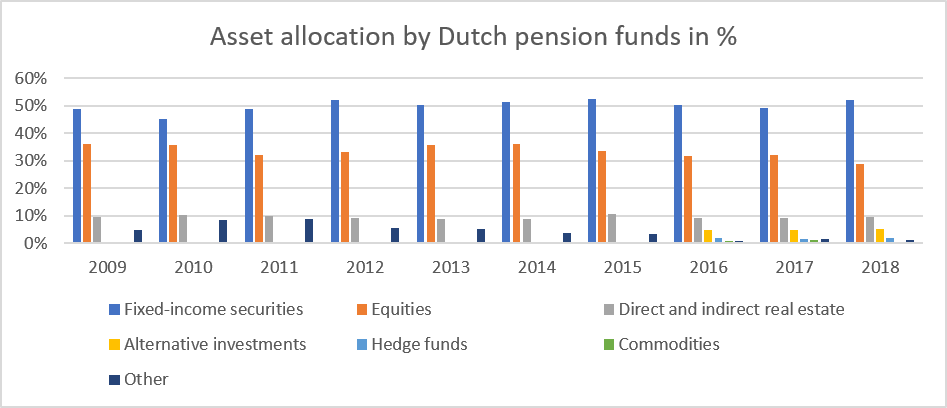

Source: DNB table 8.3 Pension funds balance sheet according to Financial Assessment Framework (FTK) dated 19 September 2019

Source: DNB table 8.3 Pension funds balance sheet according to Financial Assessment Framework (FTK) dated 19 September 2019

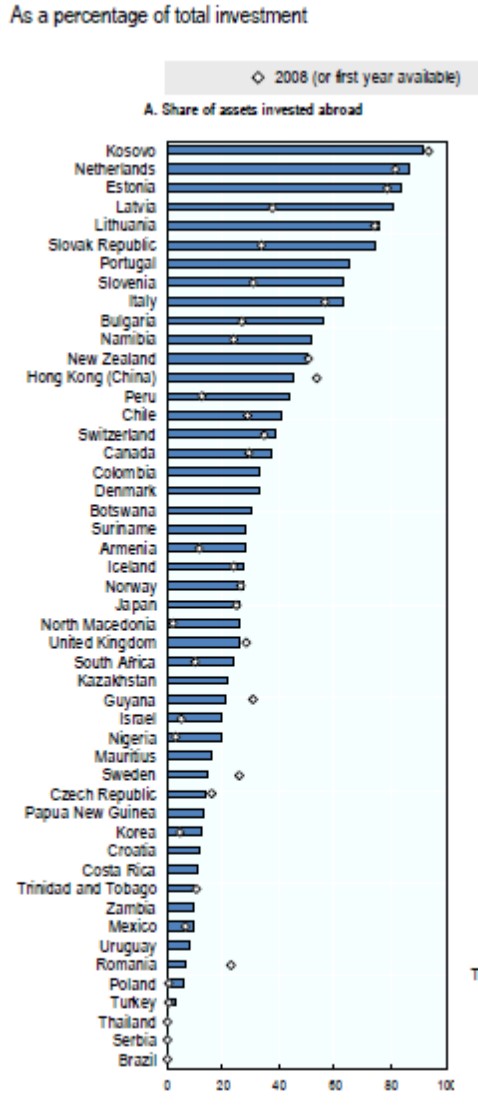

Geographical spread of investments

Dutch pension funds invest approximately 13% of their assets in the Netherlands. The other 87% are invested in other countries, see figure 1.17 (source: OECD (2019), Pension Markets in Focus, www.oecd.org/daf/fin/private-pensions/pensionmarketsinfocus.htm).

The percentage of investments in the Netherlands is higher in the investment categories of real estate, infrastructure and fixed-income securities (22%, 16% and 17% respectively). The majority of the assets invested in equities and private equity are invested in other countries (98% and 94% respectively).

Source: OECD - Figure 1.17. Assets in funded and private pension plans invested abroad in 2008 (or first year available) and 2018 (or latest year available)